Αθλητιατρική: Θεωρία – Πράξη – Θεραπεία Το βιβλίο μου «Αθλητιατρική: Θεωρία – Πράξη – Θεραπεία» ολοκληρώθηκε μετά από 5ετη συστηματική […]

ΠΕΡΙΣΣΟΤΕΡΑΓεννήθηκε και κατοικεί στην Αγ. Παρασκευή (Αθήνα). Τελείωσε με άριστα την Ιατροχειρουργική Σχολή του Πανεπιστημίου της Μπολώνια Ιταλίας. Εκπόνησε τη διδακτορική του εργασία στην ιατρική της άθλησης (Αθλητιατρική). Ειδικεύτηκε στην Ορθοπεδική Χειρουργική στο ΚΑΤ και στο 1ο Θεραπευτήριο ΙΚΑ (Παπαδημητρίου). Εργάστηκε επίσης στο Γενικό Νοσοκομείο Κέρκυρας και στο Γεν. Κρατικό Νοσοκομείο Αθηνών «Γεννηματάς».

Δείτε όλες τις φωτογραφίες μας και ενημερωθείτε για σχετικά θέματα με τις υπηρεσίες μας

Σε ομιλία του σε συνέδριο της UEFA

Mε τον Λάγιος Ντέταρι

Mε τον Μιχάλη Ζαμπίδη

Ενημερωθείτε για όλα μας τα νέα

Αθλητιατρική: Θεωρία – Πράξη – Θεραπεία Το βιβλίο μου «Αθλητιατρική: Θεωρία – Πράξη – Θεραπεία» ολοκληρώθηκε μετά από 5ετη συστηματική […]

ΠΕΡΙΣΣΟΤΕΡΑ

Παθολογικές καταστάσεις από έντονη άσκηση: H Ραβδομυόλυση είναι πάθηση που περιλαμβάνει σύνολο συμπτωμάτων τα οποία οφείλονται σε διαταραχή των κυττάρων […]

ΠΕΡΙΣΣΟΤΕΡΑ

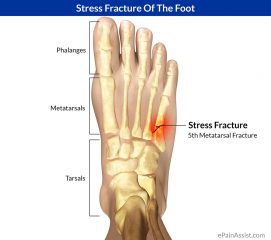

Είναι κατάγματα κόπωσης που δημιουργούνται σε αθλούμενους από υπερβολική φόρτιση. Συχνά είναι σε στρατιώτες αθλούμενους, όπου η επιβάρυνση είναι σημαντική, […]

ΠΕΡΙΣΣΟΤΕΡΑ

Η Οστεοαρθρίτιδα Γόνατος είναι μια λειτουργική ανεπάρκεια της άρθρωσης του γόνατος, που χαρακτηρίζεται από εκφύλιση του αρθρικού χόνδρου και περιοδική […]

ΠΕΡΙΣΣΟΤΕΡΑ